Front Office (Investment Focused)

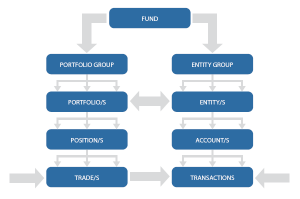

1. As trades are entered into FMO, they are grouped into positions within portfolios.

Portfolios enable the front office to separately report on the P&L of investment decisions to evaluate the performance of a particular strategy, analyst or other basis.

The P&L reported can exclude the impact of foreign currency exposures arising from trading in global products. This enables the front office to focus on the performance of the investment decision.

2. As trades are entered into FMO, the fundís NAV, P&L and chart of accounts are updated in real-time.

Back Office (Accounting Focused)

FMO provides clients with a Compliance Module where they create rules according to fund mandates that can either be enforced whilst sizing orders in the FMO Portfolio Modeller or can be run as a Post Compliance Report.

3. As trades are entered into FMO, the back office is able to electronically confirm and reconcile those trades with their prime brokers and/or administrators.

The back office is able to account for the fundís non-trade related transactions (i.e. dividends / interest / fees etc.) by posting journals linked to a portfolio and/or security. This will instantly be reflected in the portfolioís P&L, NAV and Trial Balance for the fund as a whole.