Client Need:

Sizing trades for execution on market to achieve a specified cash or investment exposure target.

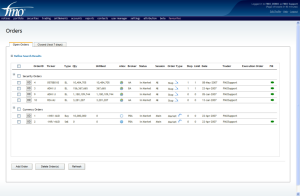

Keeping track of orders in the market or preparing orders for importing into an Order Management System (OMS).

FMO Solution:

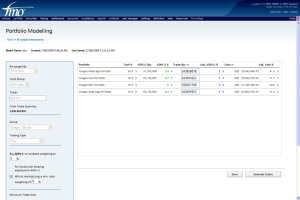

FMO assists clients in conducting ‘what-if’ analysis on portfolios to determine an optimum size trade to meet specified cash and/or investment exposure targets using the FMO Portfolio Modeler.

Trade recommendations are created as orders which can be managed in the FMO Order Management System (OMS).

Clients can use the OMS to then upload orders into external execution platforms. Fully or partially allocated fills are entered against open orders which instantly updates the fund’s NAV and P&L at both a portfolio and fund level.